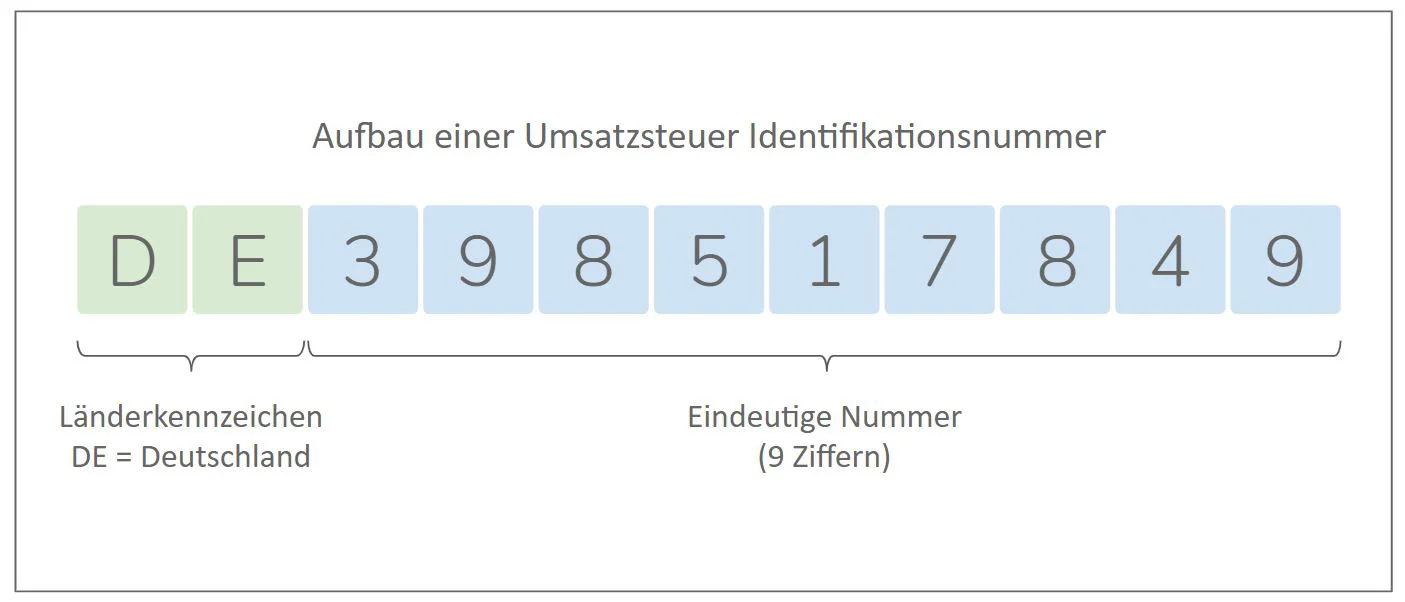

Sales Tax Identification Number (USt-ID) - What is the VAT ID?

The sales tax identification number (USt-ID) is used to uniquely identify every company in the EU. It enables transactions to be carried out between EU countries.

The sales tax identification number (USt-ID) is an independent number that entrepreneurs can apply for in addition to their tax number or tax ID. Each company within the European Union (EU) can be clearly identified using the VAT ID. It is particularly relevant for invoicing.

Tax number / Tax ID vs. VAT ID

In Europe, you have to differentiate between the following tax codes: Tax number

- Tax identification number (tax ID)

- VAT identification number (VAT ID)

Every taxable natural or legal person receives a tax number or, since 2008, a tax identification number (tax ID) from the tax office.

These two numbers are used to identify a private person or a company within Germany. They are clearly assigned and are of great importance for all administrative processes of the German tax authorities.

For entrepreneurs who do business outside of Germany, the sales tax ID (USt-ID) may also be relevant. The VAT ID can only be issued to companies and is used to identify them within the European Union (EU).

Write an invoice: tax number or sales tax ID?

Tax number and sales tax ID are particularly relevant for companies when issuing invoices. Anyone who writes an invoice must either state their tax number or their VAT ID on it.

Which number has to be given and when is explained in the next chapters.

Who needs a sales tax ID (USt-ID)?

If an entrepreneur only acts within Germany, it is sufficient to provide the tax number in business transactions - for example when issuing invoices.

As soon as a regular entrepreneur who is subject to sales tax - i.e. an entrepreneur who pays sales tax to the tax office - but has business relationships with a regular entrepreneur from another EU country, he also needs a sales tax identification number.

The following companies require a VAT ID: *

- Regular entrepreneurs who do business with other regular entrepreneurs in the EU (B2B)

The following companies do not require a VAT ID: *

- Regular entrepreneurs who only do business with private individuals / small businesses in the EU

- Small business owner

The following applies to B2B business:

- Only with the help of this VAT ID can the cumbersome VAT for transactions between EU countries be processed correctly. This is a so-called intra-community delivery / intra-community service.

Note*: Small businesses can also apply for a VAT ID if they have business relationships with businesses from other EU countries. But it is not necessary.

The VAT ID for intra-community deliveries and services

If a regular entrepreneur who is subject to VAT trades with another regular entrepreneur from another EU country, one speaks of intra-community delivery or intra-community acquisition. The sales tax ID plays an important role in both cases:

- Intra-Community supplies

- We speak of intra-community delivery when a regular entrepreneur delivers goods to another regular entrepreneur in the EU.

Both business partners are then in possession of a sales tax ID so that the delivery to the business partner is exempt from sales tax. This means that no sales tax may be shown on the invoice.

For the receiving entrepreneur, the acquisition is subject to the so-called acquisition tax - a special form of sales tax. He must pay this acquisition tax to the tax office.

Note: The VAT ID of both entrepreneurs must be listed on the invoice for intra-Community deliveries.

Intra-community services (reverse charge procedure)

One speaks of intra-community service when a regular entrepreneur provides services for another regular entrepreneur in the EU.

The tax liability is reversed (reverse charge procedure (https://debitoor.de/lexikon/reverse-charge-verfahren)): Not the service provider, but the service recipient in other EU countries has to pay the sales tax to his tax office. This procedure is regulated in the Sales Tax Act § 13b UStG.

Note *: The VAT ID of both companies must also be listed on the invoice for the reverse charge procedure.

If, on the other hand, the recipient is a private person or a small business owner, this rule does not apply:

- In this case, the standard business owner must issue an invoice with VAT shown.

Where must the VAT identification number be given?

The sales tax ID replaces the tax number on invoices. It must always be specified for invoices from intra-community deliveries or services. The VAT ID is requested directly from the business partner and then listed next to your own VAT ID on the invoice.

In addition, the sales tax identification number according to the Telemedia Act § 5 TMG must be listed in the imprint of the company website. The lack of this information can lead to a warning.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)