- Help Center

- Payroll in Germany

- German payroll reports

-

Start a company in Germany

-

Company Administration

-

Business in Germany

-

Employing in Germany

- Employing as a foreign company in Germany

- Employing talent outside of Germany with a German Company

- Typical employee benefits in Germany

- Public Health Insurance in Germany

- Digital Employment Certificate

- Parental Leave

- Social Insurance In Germany

- Private Pension Fund

- Payment of employees in Germany

- Employer cost in Germany

- Social security & pension

- Employment contracts in Germany

- Minijob

- Posting of employees to another country

- Accident Insurance

-

Accounting in Germany

-

Payroll in Germany

- Payroll setup in Germany

- Employing as a foreign company in Germany

- Payroll regulations in Germany

- Required numbers to run payroll in Germany

- German payroll reports

- German payroll & income tax

- German Payroll Tax Calendar

- Payroll Accounting changes 2023

- Digital Sick leave report

- How to manage employee sick leaves in Germany

- Government benefits & contributions

- Payroll income taxes in Germany

- Car Company Benefit & 1% Rule

- Sick leave Employer Liability

- Pension Insurance

-

Taxes in Germany

-

MyDashboard App

-

Data management & exchange

-

Liquidate a company in Germany

-

German Company forms

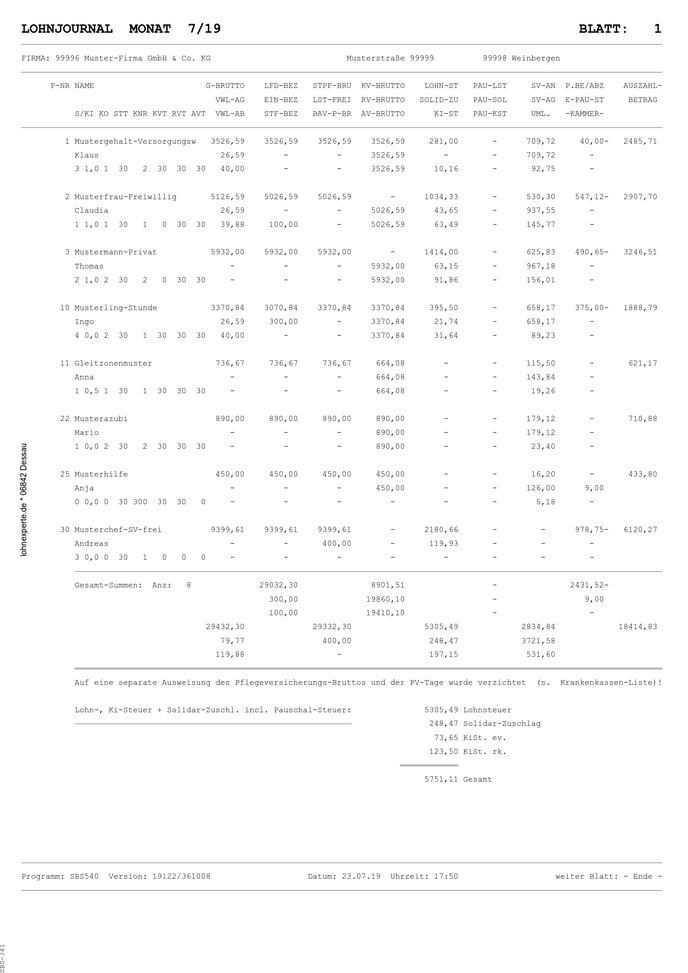

How to read my German employer payroll report?

This article describes how employers in German can read the monthly company payroll report

German Payroll Journal

A wage journal contains detailed, selected payroll data for several employees that were created in a specific period or a selected payroll period.

It is used to:

- Uncover errors that occur in the payroll run,

- Sum up accounting data of an organizational unit,

- Track data development over multiple billing periods and

- to have an additional, detailed control medium for revisions.

The payroll journal can also be used as a release document for the final payroll (e.g. by an organizational unit) vis-à-vis the payroll office / payroll / tax consultant.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)