Even in times of ELSTER, the tax assessment from the tax office can be incorrect. It is therefore important to check your tax assessment closely so that you do not give away any money.

With wage tax compact it works without a tax advisor.

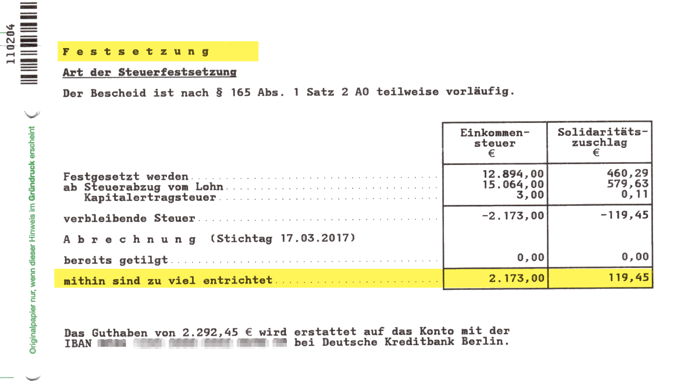

Whether the tax is paid back too much or has to be paid back can be seen from the assessment table. It is important to check whether the amounts paid for income tax, church tax and the solidarity surcharge match the data you have provided.

Before checking the calculation, you should also check your personal data, including your account details, for errors. It would be very annoying if your tax refund did not end up in your account because of a number twister.

After the personal information, there is an overview with the information on the tax calculation. Check your decision carefully on these points.

Your tax deduction and tax refund

On the first page of your tax assessment you can see whether and how much money will be reimbursed by the tax office. Check here whether the tax deduction from the wages has been correctly taken over. Compare the numbers from your employer's income tax statements. Has the tax officer possibly calculated too much wage tax?

You should take a particularly close look if you were employed by several employers in the tax year. At this point you should also check whether the savings allowances for capital-generating benefits have been correctly reported.

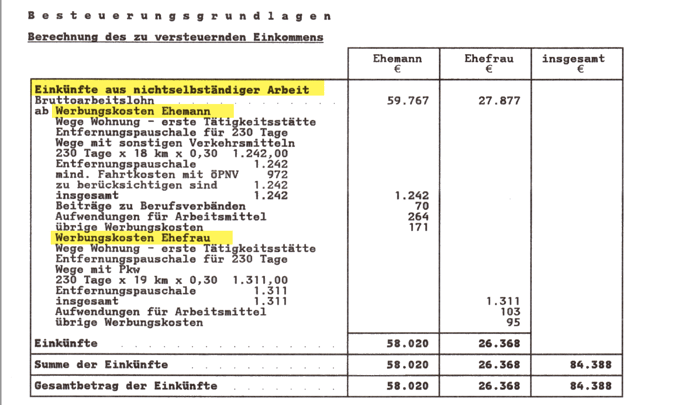

Your income and advertising costs

The next step is to check the overview of your income. Has the tax office correctly recorded all advertising costs or has something not been recognized? If your advertising costs are below the 1,000 euro limit, you should make sure that the employee lump sum has been deducted in this amount.

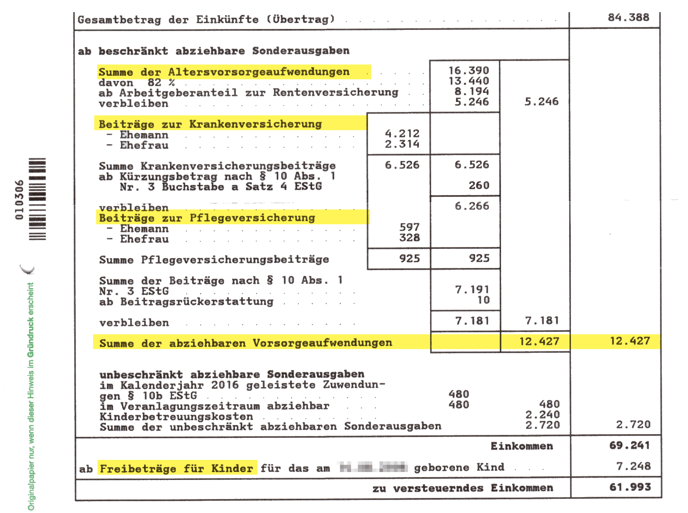

The expenses for retirement savings

Has the tax office taken all expenses for retirement into account? Have the contributions for Riester contracts been taken into account? Check the specified amount of deposits with your own documents. The tax office deducts a maximum of 2,100 euros including allowances.

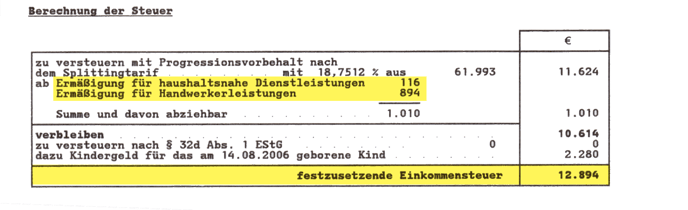

Special editions and extraordinary charges

Do the training costs match your own data? Have all donation payments been taken into account? Are the expenses for housekeeping, home care or maintenance correct, as are the costs for household services?

If you have children, the childcare costs should also be recorded correctly (2/3 of the costs, maximum 4,000 euros).

Tax-free benefits

If you received tax-free benefits in the tax year, you should check this section carefully. Even if sickness benefit, parental allowance or short-time allowance are tax-free income, they do have an impact on the level of the tax rate. Check the explanations on these points.

Free and lump sums

Last but not least, check whether all tax-free and flat-rate amounts such as the child allowance or the training allowance have been taken into account by the tax office.

Our tip: Pay particular attention to the "Explanation of the fixing" (continuous text under the calculation of the tax office), because there the tax office specifies exactly if it has not recognized certain advertising costs or special expenses! It can also be helpful here to call your tax office to find out which advertising costs have not been recognized and why.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)