- Help Center

- Accounting in Germany

- German Invoices

-

Start a company in Germany

-

Company Administration

-

Business in Germany

-

Employing in Germany

- Employing as a foreign company in Germany

- Employing talent outside of Germany with a German Company

- Typical employee benefits in Germany

- Public Health Insurance in Germany

- Digital Employment Certificate

- Parental Leave

- Social Insurance In Germany

- Private Pension Fund

- Payment of employees in Germany

- Employer cost in Germany

- Social security & pension

- Employment contracts in Germany

- Minijob

- Posting of employees to another country

- Accident Insurance

-

Accounting in Germany

-

Payroll in Germany

- Payroll setup in Germany

- Employing as a foreign company in Germany

- Payroll regulations in Germany

- Required numbers to run payroll in Germany

- German payroll reports

- German payroll & income tax

- German Payroll Tax Calendar

- Payroll Accounting changes 2023

- Digital Sick leave report

- How to manage employee sick leaves in Germany

- Government benefits & contributions

- Payroll income taxes in Germany

- Car Company Benefit & 1% Rule

- Sick leave Employer Liability

- Pension Insurance

-

Taxes in Germany

-

MyDashboard App

-

Data management & exchange

-

Liquidate a company in Germany

-

German Company forms

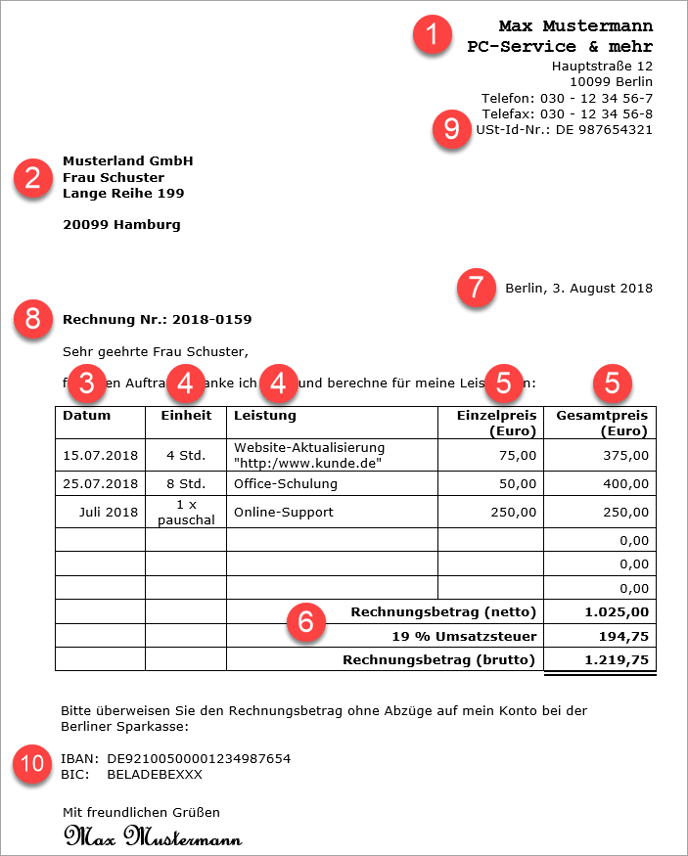

Which details belong to a correct and complete German invoice?

The tax office has no pardon for sales tax: incomplete invoice information and other violations of the formal requirements endanger the input tax deduction.

First of all, we will therefore show you which formalities you have to look out for in invoice documents.

When checking incoming invoices, you'd better not have the courage to fill in the gaps. And in your interest and that of your business partners, the reverse also applies to your own invoice forms.

The legally required mandatory information for invoice documents

The list of mandatory invoice information can be found in § 14 of the sales tax law. The following components are required for the Treasury to recognize a business document as an invoice:

- Name and address of the performing company,

- Name and address of the recipient of the service,

- Date of delivery or service,

- Quantity and description of the delivered products or type and scope of service,

- any net amounts broken down by tax rates and

- the tax amounts due thereon,

- the date of issue (= date of invoice),

- a unique invoice number and

- the exhibitor's tax number or VAT identification number.

The information on your own (10) bank account or other payment method is not mandatory, but in your own interest it is mostly indispensable: After all, the debtor must know how the invoice amount is to be paid. You can find information on further meaningful voluntary billing information on the next page.

An invoice suitable for tax authorities looks like this, for example:

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)