As of January 1, 2023, new calculation parameters will apply to statutory health and pension insurance. Every year, they will be adjusted to income trends. This ensures that social security remains stable.

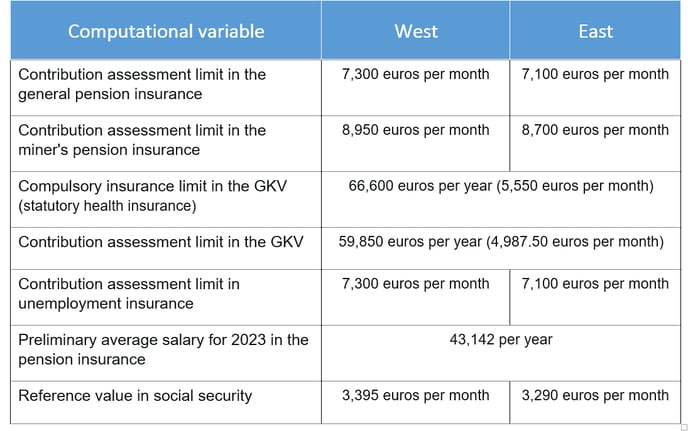

From January 1, 2023, new calculation parameters will apply in the statutory health and pension insurance. The income threshold for statutory health insurance will rise to 59,850 euros a year (4,987.50 euros a month) and the compulsory insurance threshold will increase to 66,600 euros a year (5,550 euros a month). These values are the same throughout Germany.

An employee's income is subject to contributions up to the income threshold; anything above this is non-contributory. Employees must have statutory health insurance up to the compulsory insurance limit. Those who earn more than this amount can take out private health insurance.

Changes in pension insurance

From January 1, 2023, the income limit for contributions to the general pension insurance scheme will be 7,100 euros per month in the new federal states (2022: 6,750 euros) and 7,300 euros per month in the old federal states (2022: 7,050 euros).

In the miners' pension insurance scheme, this income limit is 8,700 euros (2022: 8,350 euros) in the new federal states and 8,950 euros (2022: 8,650 euros) in the old federal states.

The average pension insurance income used to determine the earning points in the respective calendar year is provisionally set at 43,142 euros per year for 2023 (2022: 38,901 euros).

Social security

The calculation parameters are adjusted each year in line with income trends in order to keep social security stable. Without this adjustment, insured persons in the statutory pension insurance system would receive proportionately lower pensions - despite rising wages. This is because no contributions are paid for incomes above the assessment ceiling and thus no pension entitlements are acquired.

Higher earners would also "grow out of" social insurance over time. Their contribution would become smaller and smaller compared to their income.

Calculation parameters from January 1st , 2023, at a glance:

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)