Information and tips for the implementation of the One-Stop-Shop (OSS) procedure in the Accounting Department.

Content

|

General information on the OSS procedure

The One-Stop-Shop procedure (OSS) is a special rule with regard to VAT that is aimed at domestic companies. From 01.07.2021, registered companies can report centrally to the Federal Central Tax Office transactions executed and affected by the special rule.

| Important information: Please note that only sales that meet the following criteria are reported via the OSS procedure. For example, if you also use warehouses abroad, you must also register for VAT in the country of dispatch. Deliveries, where the country of dispatch is the same as the country of destination, are not reported via the OSS procedure, but via local reporting in the respective country. |

Which business transactions are affected?

The OSS procedure is aimed at companies that are domiciled in Germany and provide chargeable services to private individuals in other EU countries or make intra-Community distance sales of goods.

What does an intra-Community distance sale mean?

An intra-Community distance sale is a supply of goods to a private individual in another EU country.

| Important information: Please note that the One-Stop-Shop (OSS) regulation only concerns deliveries to private customers. Deliveries to companies whose VAT identification number (VAT ID) is known to you continue to be intra-Community deliveries. |

How does the exemption for smaller companies work?

For intra-Community distance sales until 01.07.2021, each EU country had its own delivery thresholds, which only included deliveries to the respective country. Since 01.07.2021, only a uniform EU delivery threshold of EUR 10,000.00 applies to the exemption for the OSS procedure.

The following three conditions must be met for the exemption to apply:

- The supplying company is domiciled in only one EU member state.

- The turnover generated is telecommunications, radio, and television services or services provided by electronic means or intra-Community distance sales.

- The total net turnover of the sales mentioned under 2. is less than EUR 10,000.00 in the current calendar year and in the previous year.

| Tip: You can waive the application for the exemption right from the start. This is recommended if it is already foreseeable that you will exceed the limit of EUR 10,000.00. This reduces the administrative effort of monitoring the EUR 10,000.00 sales limit and the conversion of the invoice. |

Which VAT rate is shown on the invoices?

If you use the exemption described above, your invoices can be issued with German VAT. Just so you know – the notification is done via your advance VAT return.

If you exceed the delivery threshold of EUR 10,000.00 net or decide from the beginning not to use the exemption, always issue your invoices with the VAT rate of the destination country if the deliveries are to private persons.

The right way to deal with distance sales in your accounting.

In this paragraph, we assume that you have already exceeded the EU delivery threshold of EUR 10,000.00 net or that you have voluntarily waived the application of the exemption rule. Different tax situations are presented below. The selected country names have been chosen here as examples. In the examples, Germany stands for the country in which the company is based. Poland and France are examples of all countries in the EU.

The different reporting procedures for VAT

Since the turnover of delivery is taxable where the delivery ends, your turnover from distance sales is subject to VAT in the country to which you deliver. However, how you must report the sales tax due depends on different factors. For accounting purposes, it is important to be able to distinguish between tax matters. For this reason, it is advisable to create a separate revenue account for each of the following tax cases. The posting account numbers mentioned here are taken from SKR03. Further below you will find an overview of the account numbers also in SKR04.

Scenario 1: Delivery from Germany to Germany

Here it does not matter whether the delivery is to a private person (B2C) or a company (B2B). The sales are subject to German VAT and are reported to the German tax office in the advance VAT return.

Scenario 2: Delivery from Germany to Poland to a private individual

In this case, the delivery ends in Poland and is therefore subject to Polish VAT. The sales are reported using the newly introduced OSS procedure. A revenue account for these sales could be, for example, Revenues PL/OSS (8322 I 4322)* and based on the reference account Sales/Revenues Deliveries to Private Taxable in Other EU Country (8320 I 4320)*.

*(SKR03 | SKR04)

Scenario 3: Delivery from Germany to Poland to a company

This transaction is an intra-community supply. If you know the VAT ID of your customer and list it on the invoice, the tax liability changes from you to the service recipient. You do not charge VAT and refer to the "reverse charge" procedure. You nevertheless report this turnover to the tax office as part of your recapitulative statement in Germany. You post this turnover to the account Tax-free intra-Community deliveries § 4 No. 1b UStG “Umsatzsteuer” (turnover tax) (8125 I 4125)*. For further information on intra-Community deliveries, please refer to our tax wiki.

*(SKR03 | SKR04)

Scenario 4: Delivery from Poland to Poland

If you have a warehouse in another EU country or use a fulfillment service provider that stores your goods in another EU country and ships them from there, you must register for VAT in that country. Since there is no cross-border movement of goods in this example, the sales in Poland are taxable with Polish VAT. Again, as in scenario 1, it is irrelevant whether the delivery is to a private individual or a company. The report is made in the local Polish advance VAT return. For example, a revenue account could be Revenue PL/PL (8332 I 4332)* and based on the template account Sales/Revenues Deliveries to Private Taxable in Other EU Country (8320 I 4320).

*(SKR03 | SKR04)

Scenario 5: Delivery from Poland to France to a private person

In this case, the delivery ends in France and is therefore subject to French VAT. The sales are reported using the newly introduced OSS procedure in Germany. A revenue account for these sales could be, for example, Revenues FR/OSS (8321 I 4321)* and based on the template account Sales/Revenues Deliveries to Private Taxable in Other EU Country (8320 I 4320).

*(SKR03 | SKR04)

Scenario 6: Delivery from Poland to France to a company

As already explained in scenario 4, you have to register for VAT in the other EU country because of the warehouse abroad. Nevertheless, this transaction is a tax-exempt intra-Community supply, where the tax liability is transferred to the recipient of the service. The invoice must therefore be issued by you in net, with a reference to the reverse charge procedure. You must also report the transaction in the recapitulative statement in Poland. For example, the related posting account could be B2B PL (8222 I 4222)*.

*(SKR03 | SKR04)

Overview of the different tax cases

The posting account numbers are suggestions. Please consult your tax advisor. If posting account numbers have already been assigned, there may be difficulties with the data transfer.

| Scenario | Shipping from - to | VAT number of the buyer available? | VAT | Revenue account (SKR03) | Revenue account (SKR04) |

| 1 | DE - DE | Yes or No | DE 19% | 8400; Revenues 19% | 4400; Revenues 19% |

| 2 | DE - PL | No | PL 23% | 8322; Revenues PL/OSS | 4322; Revenues PL/OSS |

| 3 | DE - PL | Yes | 0% | 8125; tax-free igL | 4125; tax-free igL |

| 4 | PL - PL | Yes or No | PL 23% | 8332; Revenues PL/PL | 4332; Revenues PL/PL |

| 5 | PL - FR | No | FR 20% | 8321; Revenues FR/OSS | 4321; Revenues FR/OSS |

| 6 | PL - FR | Yes | 0% | 8222; B2B PL | 4222; B2B PL |

Posting sales tax from other EU countries

Currently, in Accounting Software it is only possible to post German VAT directly to the entry record. Therefore, make sure that you post the entries containing foreign VAT without tax in each case.

| Max Berndt | 4160.00 euro | Debitor:10002:Max Berndt |

| R1-6 | ||

| 30.09.2020 | 8321:Revenues FR/OSS |

Figure 1: Posting a business transaction from scenario 5 without tax.

Once you have posted all sales for a period, you can calculate the sales tax due in the respective EU country and then repost it in the "Advanced" area. To do this, evaluate the results of the BWA -Betriebswirtschaftliche Auswertung (business assessment) of the individual posting accounts (see Figure 2). The amount corresponds to the gross sales in the respective country. If you now divide this value by (100 + corresponding VAT rate) and then multiply it by this VAT rate, you will get the VAT due in the respective EU country.

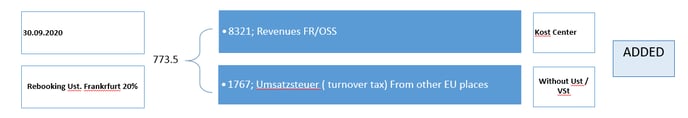

In this example, the invoice is (EUR 4,641.00 / (100+20)) x 20 = EUR 773.50. You then post the VAT due in the "Extended" area against the account VAT from deliveries taxable in the other EU country (1767 I 3817)* (see Figure 3).

Business evaluation from 01.09.2020 to 30

The BWA shown was generated on April 26th, 2022 at 10.01 a.m.

The posting records in the drill-down of the accounts are called up dynamically by clicking on the posting account. The sum of the individual posting records can therefore deviate from the account total displayed should you still make postings of the generations of the BWA within the selected evaluation period.

Sales Revenue

8321; Revenues FR/OSS

| Date | Performance Date | Booking Text | Amount | Turnover Tax/ % |

| 30.09.2020 | 30.09.2020 | Max Berndt | 4641.00 | 0 |

8322; Revenues PL/OSS 545.00 euro

8400; Revenues 19% 2453.45 euro

TOTAL 7639.45 euro

Figure 2: View posting account revenues FR/OSS(8321) in BWA

Figure 3: Transfer posting of sales tax

Note: Use the last day of the reported quarter as the posting date for the transfer posting of sales tax in order not to distort the totals of the following quarter.

Evaluation of the data and reporting to the BZSt

For reporting via the One-Stop-Shop procedure, you need the sales tax due and the net sales for each country in which you have generated sales during the reporting period.

Evaluation from Accounting Software

Once you have prepared your data as described above, you can read both the net sales and the VAT due directly from the account sheet from the Trial Balance. The difference between the ending balance and the beginning balance in the reporting period is the net revenue for that country. The sales tax due should be listed as the last entry and should have already been calculated in the previous item. The net revenue to be reported in our example is EUR 3,867.50 and the VAT due is EUR 773.50 (see Figure 4).

Lists of totals and balances from 09.01.2020 to 09.30.2020

| Account | Designation | Balance 01.09.2020 | Total Period should/have | Balance 30.09.2020 | ||||

| 8321 | Revenues FR/OSS | 0.00 | 773.5 | 4641 | 3867.5 | |||

|

Contabilitat 5321; Revenues FR/OSS |

|

|

||||||

| Date | Booking Nr | Booking Text | Contra Account | The amount Should/Have | Balance | UST acc | USt % | |

| 30.09.2020 | 1136 | Max Berndt | 10002 | 4641.0 | 4641 | |||

| 30.09.2020 | 1137 | Rebooked USt Frankfurt 20% | 1767 | 773.5 | 3867 | |||

Figure 4: Account sheet after transfer posting of sales tax

Evaluation from your merchandise management system, your billing document, or your fulfillment management tool.

As a rule, your merchandise management system, your billing document, or your fulfillment management tool should give you a way to evaluate OSS-relevant sales. The information from which country to which country the delivery takes place and which sales tax rate is shown on the invoice is here first hand. If you use Billbee, you can read here how to evaluate the OSS data.

Reporting to the Federal Central Tax Office

Forms in the OSS procedure are transmitted electronically via the BZSt online portal of the Federal Central Tax Office. An interface for applications such as BuchhaltungsButler is not yet offered. The tax return for the OSS procedure is submitted quarterly by the end of the month following the end of the quarter.

Tips and tricks in Accounting Software

These two tips refer to the posting of the different tax cases and provide both a higher level of automation in the posting and a reduction in the potential for errors.

Use automation rules via codes

If you can customize the layout of your invoices, it is recommended that you place individual "codes" in the body text of the invoice for each tax case. In turn, you can then define these codes as criteria for the automation rules. This way, your outgoing invoices will post themselves.

Automation rules and codes can look like this:

AUTOMATE BOOKINGS

Define workflows that further automate your accounting.

| Each outgoing document with full text containing ''DEnachFR'' is assigned to customer 10012. |

|

Each outgoing document with full text contains ''DEnachFR'' Posting text: Sales France. Account: 8321; Revenues FR/OSS. Tax: none USt./VSt. |

Importing A/R Invoices via CSV Import

If your enterprise resource planning system or your invoicing system allows export of outgoing invoices in the form of posting records, you can also already store the posting accounts described above in the upstream system and transfer your outgoing invoices to AccountingButler in this way in the form of customer postings. We have described the import of posting records in our knowledge base.

Important information: Please note that no document images are transferred in this way. So make sure that your vouchers are already stored in the upstream system in an audit-proof way.

Outlook

The entry into force of the OSS procedure has not resulted in any direct changes to the preparation of accounting. Only the lowering and merging of the delivery thresholds into a single EU delivery threshold means that more companies than before will have to record and report taxable sales abroad.

Important information: Please note that the topic of the one-stop store goes deep into VAT law. According to §6 StBerG we are only allowed to provide support to a limited extent. For inquiries that go beyond the content of this knowledge base article, please contact your tax advisor.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)