We will tell you what the energy price lump sum that is implemented one-time in 2022 is all about.

2. What is the significance of September 1, 2022, for the EPP?

4. When does the employer pay the EPP to its employees?

After increasing the personal tax allowance "Grundfreibetrag" the government decided on a one-time benefit that will be paid out with the payroll in September.

Therefore, we have received a one-time benefit for employees subsidized by the German government.

It's called "Energiepreispauschale" and should attenuate increased costs for electricity and heating by paying out 300€ to every employee.

The employers take care that this will be paid out with the September salary but it won't be on the employer's back.

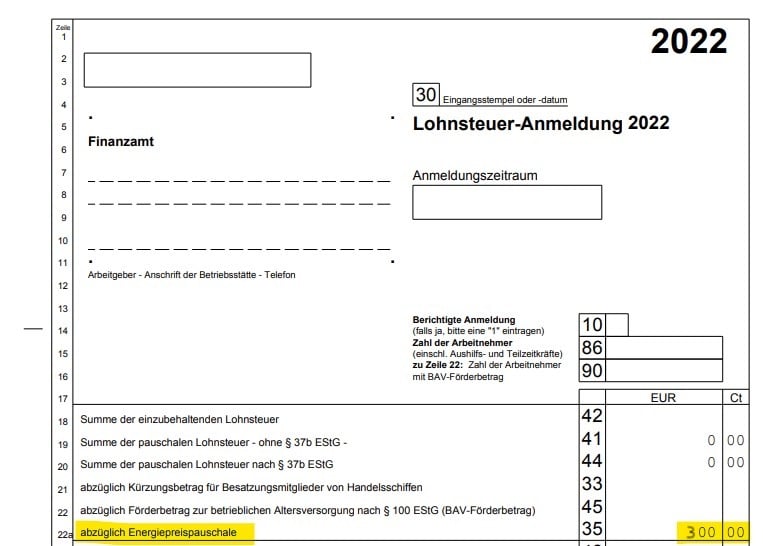

You can see the August statement and the deduction (abzüglich Energiepreispauschale) of 300€ down below.

1. Who is eligible?

All people who during the year 2022 reside or usually reside in Germany and who in 2022 will receive income from one of the following types of income:

- § Section 13 Income Tax Act (agriculture and forestry),

- § Section 15 of the Income Tax Act (trade),

- § Section 18 Income Tax Act (self-employed work) or

- § Section 19 (1) sentence 1 number 1 Income Tax Act (income as an employee from active employment).

- Persons who live in Germany and are employed by an employer abroad (In these cases, however, the EPP is not paid through the employer)

2. What is the significance of September 1, 2022, for the EPP?

The law stipulates that the entitlement to the EPP arises on September 1, 2022.

However, September 1, 2022, does not mark a cut-off date for the eligibility requirements. Any person who has met the eligibility requirements at some point in 2022 is entitled to the payment.

3. How is the EPP determined?

In every case in which an income tax return is filed for the year 2022, the tax office checks whether there is an entitlement to the EPP.

Employees who have not yet received their EPP via their employer will also receive it on the basis of the information they provide when filing an income tax return for 2022.

A special application is not required. In addition to income tax, the EPP will also be determined in the tax assessment notice.

4. When does the employer pay the EPP to its employees?

Employers must generally pay the EPP to their employees in September 2022.

In the case of advance payment of wages/salaries/benefits, payment to be made with the payroll for the wage payment period of September 2022 is not objectionable from a tax point of view.

If the employer submits the wage tax return quarterly, the EPP may be paid out to the employee in October 2022.

If the employer files the income tax return annually, it may completely waive the payment to its employees. The employees may in this case choose to receive the EPP by submitting an Income tax return for the year 2022.

If for organizational or payroll reasons the payout in September 2022 is not possible, there are no objections if the payment is made together with the wage/salary payment is made for a subsequent payroll period of the year 2022, at the latest by the time of transmission of the wage tax statement for the employee takes place.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)