The German VAT declaration briefly explained

As an end customer, you, of course, are familiar with it: the sales tax, which when buying products or services - Usually in the amount of 7 or 19% - is added to the net sales price. Of course, companies must not withhold this tax but must pass it on to the tax office. In return, however, companies can reclaim input tax, i.e. the sales tax on incoming invoices, from the tax authorities.

However, instead of transferring the difference between sales tax and input tax to the tax office once after the annual sales tax return, entrepreneurs have to make payments to the tax authorities several times during the year based on the so-called sales tax advance notification.

The background is simple: The tax office protects itself against payment defaults through the possible insolvencies of companies through the pre-year VAT registration and at the same time has an interest rate advantage over one annual payment. The entrepreneur, in turn, benefits from greater planning security, since he does not have to "suddenly" transfer the high total amount to the tax office after the calendar year.

Who has to submit the advance VAT return?

Since the submission of the advance tax return means a certain amount of time and money, you should consider as a business owner whether you do not want to display the sales tax on your own bills at the beginning. In such a case, one is referred to as a small business owner.

In order to make use of the so-called small business regulation, the turnover limit of 22,000 euros per year must not be exceeded. Find out on our page on small business regulation when it can make sense to forego the small business regulation and the advance tax return even with low sales performance.

If you are not a small business owner, but belongs to a professional group with a specific job, which is described in § 4 of the sales tax law, you do not have to report sales tax by registering the sales tax with the tax office. As a well-known example, curative treatments in the field of human medicine are to be mentioned, such as by doctors, naturopaths or physiotherapists. As a rule, no sales tax will be found on invoices of these professional groups.

For all other companies, there is no way around pre-registering for VAT: You are legally obliged to regularly report VAT to your tax office.

Pre-registration period: make the advance VAT registration monthly or quarterly?

Are you not a small business owner or do you have a job that is exempt from VAT? Then you should now check how often you have to submit the VAT return to the tax authorities each year.

For start-ups, the legal situation is very clear: within the first two years, the advance tax return must be submitted every month. It is only from January 1st, 2021 that new entrepreneurs can submit the sales tax advance notification on a quarterly basis.

If you have successfully survived the first two years as an entrepreneur, you can switch to a quarterly pre-tax return on request. However, this is only possible if the so-called sales tax burden of the previous year does not exceed EUR 7,500. As a founder, you should check this carefully, as it can save a lot of work. The following table provides a good overview of which thresholds apply for which pre-registration period:

| Vorjahres-Umsatzsteuerzahllast | Voranmeldezeitraum |

| > 7.500 Euro | monthly |

| 1.000 – 7.500 Euro | quarterly |

| < 1.000 Euro | yearly |

To calculate the previous year's sales tax burden, simply deduct the input tax on your incoming invoices from the sales tax paid on your outgoing invoices.

It is very exciting to see, by the way, that with very low amounts below EUR 1,000, the advance tax return in the new year can be completely dispensed with and the submission of the sales tax return after the end of the year is completely sufficient.

Deadlines for advance sales tax return 2020 with and without a permanent extension

Whether the VAT return has to be submitted quarterly or monthly - the deadline for filing the VAT return is always on the 10th of the following month after the end of the pre-registration period.

If you have applied for the extension of the long-term period, you even have another month to submit the advance notification. The following table shows an example of the concrete submission dates. The pre-registration period is the respective business month or business quarter.

Deadlines for pre-registration periods 2019 and 2020.

| Voranmeldezeitraum | Abgabefrist | Abgabefrist mit Dauerfristverlängerung |

|---|---|---|

| Abgabetermine für Monatszahler | ||

| November 2019 (monatlich) |

10.12.2019 | 10.01.2020 |

| Dezember 2019 (monatlich) |

10.01.2020 | 10.02.2020 |

| Januar 2020 | 10.02.2020 | 10.03.2020 |

| Februar 2020 | 10.03.2020 | 10.04.2020 |

| usw. ... | ... | ... |

| Dezember 2020 | 10.01.2021 | 10.02.2021 |

| Abgabetermine für Quartalszahler | ||

| 4. Quartal 2019 (quartalsweise) |

10.01.2020 | 10.02.2020 |

| 1. Quartal 2020 (quartalsweise) |

10.04.2020 | 10.05.2020 |

| 2. Quartal 2020 | 10.07.2020 | 10.08.2020 |

| 3. Quartal 2020 | 10.10.2020 | 10.11.2020 |

| 4. Quartal 2020 | 10.01.2021 | 10.02.2021 |

If the deadline for the advance tax return falls on the weekend or a holiday, then the deadline is automatically postponed to the next working day.

Any company can apply for a long-term extension without justification to the tax office and is usually always accepted. To do this, submit the application electronically to the tax office by Elster by 10 February if you have a monthly pre-registration period and by 10 April if you have a quarterly pre-registration period. If you start up your business during the year, the 10th day of the month is the deadline in which you have submitted a VAT return for the first time.

In order for the tax office to accept the extension of the long-term period, you must also make a special advance payment of up to one-eleventh of the previous year's VAT burden in addition to the application. This special advance payment will then be deducted from the last pre-tax return in the year. With this special advance payment, the tax office also secures itself against possible payment defaults.

Missed the deadline for submitting the VAT return?

Did you have a lot to do and missed the deadline to register for VAT? Then it may well be that you have to pay a delay surcharge of up to 10% of the VAT burden. In addition, if the payment arrives too late at the tax office, an additional 1% of the tax liability can be charged for each month or part thereof. When paying by bank transfer, however, you get a three-day grace period.

With low sales, such fines are still manageable, but they do not make a good impression on the tax authorities. A tax audit can result in several offenses.

By the way: Even if you have not generated sales relevant to VAT in a pre-registration period, you are still obliged to submit a pre-registration. In this case, don't be surprised if a warning letter is suddenly on your table.

Advance sales tax registration via ELSTER: how it works

Entrepreneurs are obliged to electronically transfer the VAT return - using ELSTER software from the German tax authorities. In the following, you will find out exactly how this works and what you should pay special attention to when filling in the advance tax return using Elster.

Log in to Elster, download the certificate and install the software

The Elster software exists in two different versions: You can either access Elster directly via your browser or download the Elster software onto your computer. We recommend downloading the software, as this allows you to work on your sales tax pre-registration even without Internet access and the likelihood of data loss is lower.

If you have not yet registered for Elster, visit the website www.elster.de and carry out the registration using the ELSTER Basis procedure. To do this, you have to provide some personal data such as your identification number or tax number so that Elster can identify you.

After confirming your email address, you will receive mail from the tax authorities in the next few days. The activation code contained in the post is for the final activation of your account and enables you to download a pfx file: your personal authentication certificate. In this context, you must now also choose a PIN, which you will need later in connection with the certificate. Make a note of both the PIN and the location of the certification file - in the future, they will both be used to identify your transmissions via ELSTER.

Now you are ready to go: You can now download and install the Elster software free of charge before you then go to the next step to pre-register sales tax.

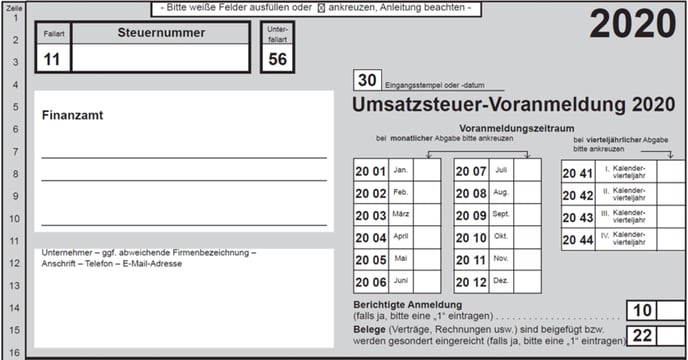

Complete the ELSTER form correctly

Start the Elster software and open the form for the advance tax return. In the first step, you provide general information about your company and the tax office responsible for you. You then have to decide on the pre-registration period for which you would like to submit the current VAT pre-registration.

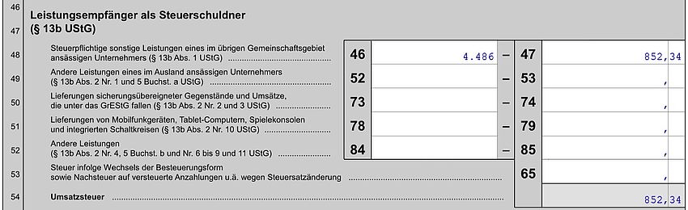

Many of the following form fields sound extremely complicated, but most of them are not relevant for many people starting up a business and do not need to be filled out. We concentrate and therefore below on the most important information when registering sales tax via ELSTER:

- Taxable sales (page 1): Under the heading "Taxable Sales", two fields are particularly relevant for a large number of start-ups: taxable sales at the tax rate of 7% and taxable sales at the tax rate of 19%. Enter all of the net sales generated by you with the 7 or 19% are taxed and do not specify cents.

- Deductible input tax amounts (page 2): Now it is your turn to take your incoming invoices: In the field "Input tax amounts from invoices from other companies [...]", most entrepreneurs can enter the input tax from invoices that they themselves have paid to suppliers or service providers. The left-field serves the net invoice amount, the right field should be filled with the corresponding sales tax.

Now you are almost there: Carry out the automatic plausibility check and then send your pre-sales tax return to the tax office stating your PIN and the location of the certificate.

Very important: After sending the VAT return, print out the transfer log or save it in a safe place in order to be on the safe side with any later complaints.

Target or actual taxation?

A topic that is often neglected when registering sales tax among founders should be briefly mentioned here again: the question of the target and actual taxation.

In contrast to the actual taxation, in the case of the target taxation, the invoice date of an outgoing invoice issued by the entrepreneur is the day on which the sales tax officially flowed. Accordingly, this date must also be regarded as relevant for the pre-registration for sales tax when allocating sales to the respective pre-registration period.

However, if an entrepreneur pays tax in accordance with the actual taxation, the advance tax return does not apply to the invoice date of the outgoing invoice but the actual cash flow - i.e. the date of arrival of the money on your own account. With actual taxation, the entrepreneur, therefore, has an interesting advantage that he should take advantage of.

Incidentally, the type of taxation is irrelevant for incoming invoices: as soon as an incoming invoice is recorded, it can also be sent to the tax office by pre-registering VAT.

And when do you decide on the type of taxation? As a business founder, you have the choice between actual or target taxation when filling out the questionnaire for tax registration, If one of the following criteria is met, the actual taxation can be applied for:

- The sales projected for the calendar year will probably not exceed 500,000 euros in the year of foundation

- The entrepreneur is not obliged to double-entry bookkeeping - i.e. accounting

- The founder is a member of a free profession

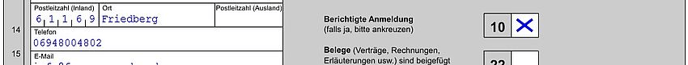

Corrected VAT pre-registration: correct errors

It is not uncommon for you to notice that a voucher has been forgotten only after you have submitted your VAT registration or the tax advisor indicates incorrect registration. For this purpose, Elster offers a corrected advance tax return, which allows the correct data to be re-transmitted to the tax office.

To do this, simply put a cross under "Corrected registration" in Elster, fill out the Elster form as usual and send it. But beware: A correction of the VAT registration can be viewed from a legal point of view as self-declaration not to provide corrected registration with incorrect information again, as this may have far-reaching consequences.

The annual sales tax return summarizes all advance sales tax returns

The sales tax return, sometimes also referred to as the annual sales tax return is ultimately nothing other than the summary of all sales tax returns made in one year. Any corrections must also be incorporated here, for example, if invoices are forgotten or receipts from employees are submitted too late. Make sure that there are no other inconsistencies between the information in your advance VAT returns and the annual VAT return. Such errors quickly become apparent to the tax authorities and can lead to a tax audit.

The sales tax return as well as the advance sales tax returns are transferred to the tax office by magpie and must be submitted electronically by May 31 of the following year at the latest. An extension of the submission deadline until September 30 can be approved by the tax office upon request.

What many do not know: Even small entrepreneurs who have made use of the small business regulation are obliged to submit a VAT return, even if You have not included the sales tax on your invoices. The submission of the sales tax return via Elster does not involve any great effort for small business owners since, in addition to general information about the company, only the sales from the last two years have to be stated.

Do not make the advance tax return yourself? Two alternatives

Finally, the question arises as to whether it is not possible to save the work of pre-registering VAT, including the VAT return, bypassing it on to a tax advisor or by having accounting software take over this task.

A tax advisor is certainly the most convenient solution, no question. If the latter already takes over the bookkeeping for you and you have to pass on all receipts every month anyway, then you should actually think about the Submit advance sales tax return. The additional costs are limited here since, in addition to the accounting, there is hardly any time for the tax consultant.

If you have done your bookkeeping by hand until now and have maintained your receipts in Excel spreadsheets, but do not want to spend the money on the tax consultant, an accounting program can be a sensible solution. Good accounting software - whether on your PC or directly in the cloud - nowadays usually has an interface to Elster, so that the advance sales tax return and later the sales tax return can be transferred to the tax office without additional costs. And this without any real additional effort, provided that you have carried out your bookings with the software correctly from the start.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)