- Help Center

- MyDashboard App

- My Payroll Service

-

Start a company in Germany

-

Company Administration

-

Business in Germany

-

Employing in Germany

- Employing as a foreign company in Germany

- Employing talent outside of Germany with a German Company

- Typical employee benefits in Germany

- Public Health Insurance in Germany

- Digital Employment Certificate

- Parental Leave

- Social Insurance In Germany

- Private Pension Fund

- Payment of employees in Germany

- Employer cost in Germany

- Social security & pension

- Employment contracts in Germany

- Minijob

- Posting of employees to another country

- Accident Insurance

-

Accounting in Germany

-

Payroll in Germany

- Payroll setup in Germany

- Employing as a foreign company in Germany

- Payroll regulations in Germany

- Required numbers to run payroll in Germany

- German payroll reports

- German payroll & income tax

- German Payroll Tax Calendar

- Payroll Accounting changes 2023

- Digital Sick leave report

- How to manage employee sick leaves in Germany

- Government benefits & contributions

- Payroll income taxes in Germany

- Car Company Benefit & 1% Rule

- Sick leave Employer Liability

- Pension Insurance

-

Taxes in Germany

-

MyDashboard App

-

Data management & exchange

-

Liquidate a company in Germany

-

German Company forms

How to read my payroll journal?

This article describes how to read your payroll journal in MyDashboard.

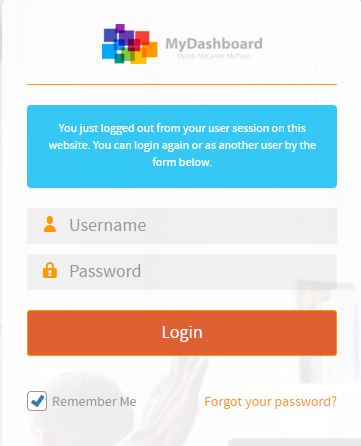

Please login on the homepage https://mydashboard.consultinghouse.eu

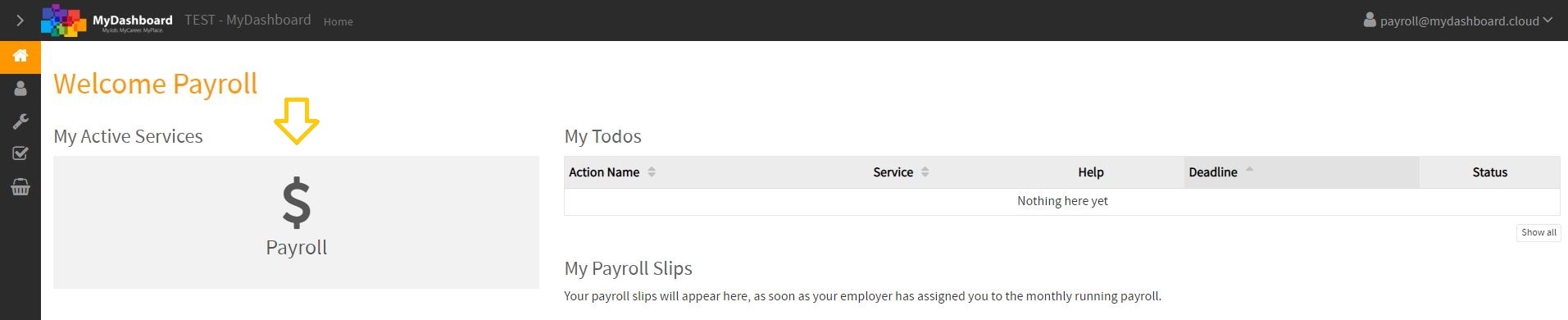

On the mainpage, please click on your active services "Payroll"

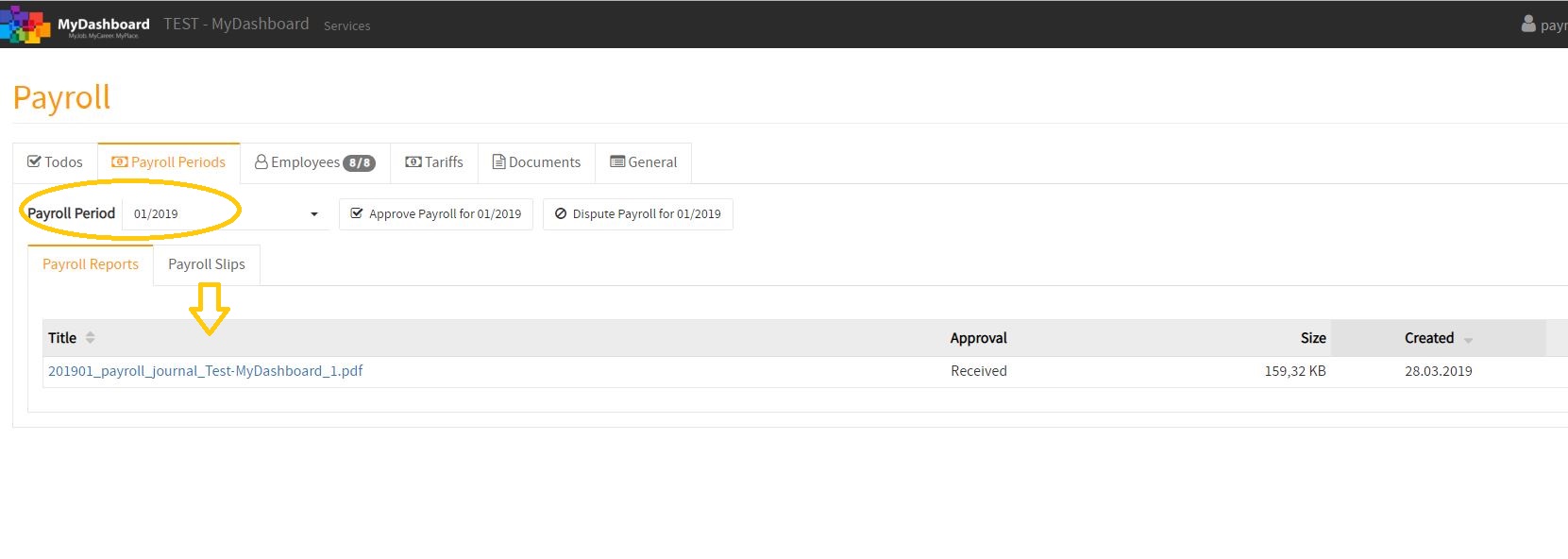

Select the payroll peroid and click in the sector "Payroll Reports" on your payroll journal

MONTHLY PAYROLL JOURNAL

.jpg)

1. S -> tax class

2. KI -> child tax allowance

3. KO -> religion (catholic, protestant...)

4. G-BRUTTO -> gross salary

5. VWL-AG / VWL-AB -> capital forming payments

6. LFD-BEZ -> ongoing compensation (e.g. salary)

7. EIN-BEZ -> one time compensation (e.g. bonus)

8. STF-BEZ -> tax- free compensation (e.g. job ticket)

9. STPF-BRU -> taxable gross compensation

10. LST-FREI -> withholding tax free amount

11. BAV-P-BR -> private pension

12. KV-BRUTTO -> health insurance contribution assessment limit (max. 4.537,50 €)

13. RV-BRUTTO -> pension insurance contribution assessment limit (max. 6.700 €)

14. AV-BRUTTO -> unemployment insurance contribution assessment limit (max. 6.700 €)

15. LOHN-ST -> withholding tax

16. SOLID-ZU -> solidarity tax

17. KI-ST -> church tax

18. PAU-LST -> lump-sum withholding tax

PAU-SOL -> lump-sum solidarity tax

PAU-KST -> lump-sum church tax

19. SV-AN -> social security employee part

20. SV-AG -> social security employer part

21. UML. -> further employer contribution (for sickness leave, maternity leave and insolvency)

22. P. BE/ABZ -> personal relation (travel expense reimbursement), personal deduction (advance

payment)

23. E-PAU-ST -> only relevant for a "minijobber"

24.-KAMMER- -> chamber contributions (only in regions Saarland & Bremen)

25. AUSZAHLBETRAG -> net payment

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)