A limited partnership may according to § 161 Abs. 1 HGB for the purpose of commercial trade or according to § 161 Abs. 2 i. V. m. § 105 Paragraph 2 HGB for the administration of own assets

Overview

The limited liability company & Compagnie Kommanditgesellschaft (GmbH & Co. KG ) is a limited partnership (KG) under German law.

Unlike a typical limited partnership, the personally and unlimitedly liable partner (general partner ) is not a natural person, but a limited liability company (GmbH).

Goal

The aim of this corporate law construction is to exclude or limit liability risks for the people behind the company.

Shareholder

| German | English | Liability |

| Kommanditistin | Limited partner | Unlimited liability |

| Komplementärin | General partner | Limited liability |

Limited partnership

A limited partnership (in Germany abbreviated KG) is a partnership or legal persons have come together to create a commercial enterprise, whereby for liabilities of the company at least one partner has unlimited liability and at least another partner has limited liability (limited partner. Limited partners are only liable up to the amount of their contribution and not with their private assets.

Purpose

A limited partnership may according to § 161 Abs. 1 HGB for the purpose of commercial trade or according to § 161 Abs. 2 i. V. m. § 105 Paragraph 2 HGB for the administration of own assets.

Particularities

Since the GmbH & Co. KG is one of the commercial partnerships, the conversion of the GmbH into a GmbH & Co. KG with a change of form is possible, but some special features must be observed.

Advantages of the GmbH & Co. KG

The GmbH & Co. KG is one of the most common forms of company in the business world in the Federal Republic of Germany. In fact, choosing this legal form can offer the shareholders various advantages in individual cases. However, numerous different variants of the GmbH & Co. KG have developed over the decades, which are not equally suitable for every company due to their partly different properties.

One advantage of the GmbH & Co. KG compared to the GmbH is the easier payment of annual surpluses. As a rule, in the absence of a capital preservation principle, these can be paid out in full to the shareholders.

Conversely, without the principle of capital preservation, the raising of capital is made easier at the same time, since this does not inevitably increase the capital stock on the balance sheet, as in the GmbH. Potential investors can thus participate as limited partners without increasing the disbursement block under Section 30 GmbHG.

In addition, the GmbH & Co. KG is more flexible than the GmbH due to the informal change of shareholders.

The different variants of the GmbH & Co. KG

The person and participation identical GmbH & Co. KG

The person and participation identical GmbH & Co. KG is the most common variant in practice. In this form, the same persons with identical shareholdings are both limited partners of the GmbH & Co. KG and shareholders of the general partner GmbH. This has the advantage that the shareholders in both companies control the decision-making process and is therefore particularly recommended for pure entrepreneurial companies. However, such a constellation requires careful individual drafting of the articles of association, as the copies of the general partner GmbH and GmbH & Co. KG must be coordinated.

A sub-form exists if a single shareholder is solely involved in the general partner GmbH and the GmbH & Co. KG. This permitted variant of the GmbH & Co. is known as a "one-person company". For this form of organization, too, individual drafting of the articles of association is advisable, particularly due to inheritance law aspects, if a continuation of the company is desired after the death of the partner.

The GmbH & Co. KG, which is not identical in terms of persons or interests

As you can easily see from the name, this variant of the GmbH & Co. does not have a shareholding identity with regard to general partner GmbH and GmbH & Co. KG. This type of design occurs primarily in the form of a public company. In a public company, the business partners are usually both limited partners of the GmbH & Co. and shareholders and (often) managing directors of the general partner GmbH. In addition, pure investors are only accepted into the GmbH & Co. as limited partners. Since the rights of limited partners under company law are very limited, this can prevent the lenders from having too much influence on the company's business operations. Conversely, a company becomes attractive for investors who, for reasons of time, want to leave the day-to-day business to the entrepreneurs.

The unitary society

Another variant of the GmbH & Co. is the so-called unit company. The constitutive feature of the unit company is that the KG itself is the sole shareholder of the general partner GmbH. Legal harmonization is achieved through the direct participation of the KG in its general partner. Complicated legal drafting of the articles of association is thereby largely obsolete. For this reason, the unitary company is seen in parts of the legal specialist circles as the most consistent and perfect form of the GmbH & Co. KG. However, this practiced consequence also leads to the greatest difficulty of the unit society. Since the managing director of the general partner GmbH, as the indirect managing director of the KG, also represents it in the general meeting of the general partner GmbH, a vicious circle of the omnipotence of the GmbH managing director. In order to prevent this, the value should be placed on a preventively counteracting contract drafting at the time of founding a unitary company.

The UG (limited liability) & Co. KG

As a sub-form of the GmbH (cf. § 5a GmbHG), in principle, all legal provisions and principles applicable to the GmbH are transferable to the UG (limited liability). Therefore, the sub-form of UG (limited liability) & Co. KG is a permissible variant of GmbH & Co. KG. In addition to the well-known economic disadvantages of the UG (limited liability), in particular poor creditworthiness, the legally required formation of reserves within the framework of a UG (limited liability) & Co. is particularly questionable. Because usually, the general partner does not participate in the capital of the KG. This applies accordingly to participate in current profits. Without sufficient financial inflow, however, the formation of reserves within the UG (limited liability) is considerably more difficult or even completely impossible. The legal admissibility of such a procedure has not yet been conclusively clarified.

The star-shaped GmbH & Co. KG

A star-shaped GmbH & Co. KG is a structure in which a GmbH acts as a general partner in various limited partnerships. This fundamentally admissible design variant requires, on the one hand, the permission of the limited partnerships to the GmbH with regard to multiple representations. On the other hand, when drafting the contract, special attention must be paid to the interlinking of the individual contracts.

Conversion into GmbH & Co. KG under commercial law

The conversion law provides various options for converting a corporation into a partnership:

- Merger

- Split

- A simple change of form can also be considered. After that, a corporation can be converted into a partnership or a GbR *

*The previous regulation, according to which the conversion of a corporation into a partnership was inadmissible if a corporation was involved in the partnership, no longer applies.

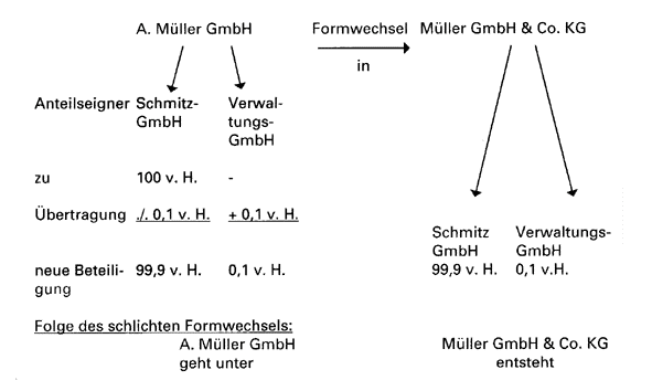

Example

A. Müller GmbH operates a wholesale and retail trade with textiles. The share capital is 500,000 DM. The GmbH is to be converted into a GmbH & Co. KG by way of the change of legal form. The sole limited partner will be Schmitz-GmbH, which held all shares until the conversion. The general partner is to be a management GmbH newly founded by the shareholders of Schmitz-GmbH with a dwarf share.

- The GmbH becomes the sole limited partner

- The general partner is to be a newly founded Verwaltungs-GmbH with a dwarf share.

Required information

Conversion report

In the written conversion report § 192 UmwG, the legal and economic reasons for this way of conversion must be set out:

- Legal and economic reasons

- Consequences of the change of legal form for the shareholders

- Draft conversion resolution

- Include a statement of assets in which the assets and liabilities of the form-changing GmbH are to be recorded with their real value. *

* However, this list is not a balance sheet in the sense of the HGB. Therefore, self-created intangible assets, for example, goodwill, can also be applied.

A conversion report is not required if all shareholders waive it - in a notarized form. The waiver is particularly useful for family businesses in order to avoid disclosure of the actual value relationships.

Conversion resolution

The change of legal form into a GmbH & Co. KG requires a resolution § 193 UmwG of the shareholders of the legal entity changing the legal form. For this, a majority of at least three-quarters of the votes cast at the shareholders' meeting of the GmbH is required § 233 Paragraph 2 UmwG.

Specifically, §§ 194 and 234 UmwG specify the content of the Conversion decision heard. These are in particular:

- the legal form of the new company - GmbH & Co. KG - as well as its company name,

- the limited partners with the amount of their respective liability contribution,

- which shareholders will become general partners in the future,

- the participation ratio of

- A shareholder in the GmbH & Co. KG,

- the consequences of the change of legal form for the employees and their representatives, and the measures envisaged in this respect.

Procedure

Registration in the commercial register

The new legal form of the legal entity changing the legal form must be registered for entry in the commercial register by the representative bodies of the GmbH. Upon registration, the GmbH becomes a GmbH & Co. KG. The shareholders now receive shares in the converted KG for their GmbH holdings. The change of legal form is thus completed under commercial law.

Change of form in the UmwStG 1995

In addition to the civil law peculiarities, a number of tax law peculiarities must also be taken into account. It should be noted that the corporate tax reform resulted in changes in the utilization of losses almost retrospectively as of January 1, 1997.

Conversion date - tax-transfer date

Under civil law, the registration of the change of form is constitutive. It takes place with the entry without retroactive effect. With regard to tax law, a retroactive effect of the conversion date up to eight months before the registration of the change in the commercial register § 14 UmwStG can also be decided upon.

In practice, the conversion is often chosen at the turn of the year. That saves an interim balance. Should the change of legal form aim for December 31 of the previous year, the registration with the commercial register has to be carried out by 31.8. of the current year. But it should also be considered whether the 1.1. should be determined as the conversion date. This has the advantage that any tax burdens, for example, due to a takeover profit for the shareholders, only arise in the current year, i.e. one year later. In addition, a profit declaration for the previous year is not required for the GmbH & Co. KG.

The conversion does not have any retroactive effect on sales tax. Until the change of form is entered in the commercial register, the transferring GmbH must submit its own advance VAT returns. The same applies to the annual sales tax return.

The accounting of the GmbH will be continued until the conversion is entered in the commercial register. The continuation by the GmbH & Co. KG is seamless because the identity of the company does not change and the assets are not transferred.

Tax accounting peculiarities

For further information or guideline please contact www.counselhouse.eu or your tax advisor.

Checklist

The following steps are necessary when converting a GmbH into a GmbH & Co. KG:

- Establishment of an administrative GmbH as a future general partner GmbH.

- Participation of the Verwaltungs-GmbH in the GmbH to be converted minimum capital share = 500 DM; possibly via a trust relationship.

- Draft of the conversion resolution the minimum requirements result from § 194 and § 234 UmwG.

- Submission of the draft to the works council no later than one month before the day of the shareholders' meeting is to resolve the change of legal form. Whether a notice on the company's notice board is sufficient for this should be clarified beforehand with the registry judge.

- Conversion report with a statement of assets ready waiver possible.

- Inform shareholders about the change of legal form.

- Resolution on the change of legal form. The shareholders must pass the conversion resolution in a notarized form in a shareholders' meeting, § 193 UmwG.

- Registration and entry of the new GmbH & Co. KG in the commercial register. The attachments to be attached are described in § 199 UmwG.

Disclaimer

This article is provided for informational purposes. For legal and tax advice, please contact www.counselhouse.eu or your local tax advisor.

-1.png?height=120&name=Consultinghouse-Market-Entry-Germany%20(1)-1.png)